Welcome to Understanding Islam

Discovering the Religion of Peace and Compassion

Discover

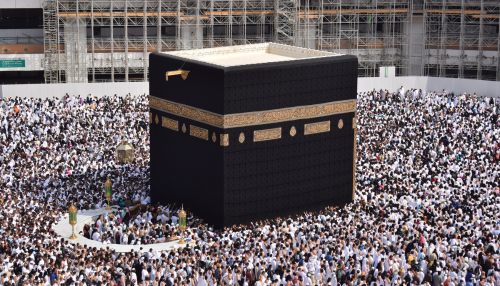

Discover key principles of Islamic faith, such as the belief in One God (Allah), the prophethood of Muhammad (peace be upon him), and the Holy Qur’an – the sacred text of Islam.

Connect

Connect with countless others who share your curiosity and passion for learning about the diverse Muslim community around the globe.

Inspire

Inspire social harmony and unity by breaking down barriers and misconceptions about Islam, promoting dialogue fostering understanding.

About us

Understanding Islam is an inclusive platform, dedicated to presenting the true essence and spirit of Islam. Our mission is to provide accurate, reliable, and unbiased information to people seeking to learn about Islam.

Latest news

- From Science Po Paris to Harvard, campuses are mobilizing for Palestine

- Stop the criminalization of support for Palestine!

- No to the criminalization of solidarity with the Palestinian people!

- Spanish visa for Algerians: BLS and the business of appointments

- Ramy Abu Tayyem, the little boy from Gaza who protects the Koran from the destructive Zionist fury

- To put an end to alienating religiosity